life, p&c, and health

Insurance

FCI offers Insurance Carriers, Brokers, and Agencies a cybersecurity solution that solves the last mile of regulatory compliance and information security policy adherence for consistent enforcement of controls and evidence of compliance.

CEOs & BOARDS of DIRECTORS

What to ask your team

Improved cybersecurity protection and regulatory compliance

Why the Last Mile of Cybersecurity Matters

Cybersecurity has become a critical business function

Internal Challenges

Ongoing regulatory compliance, audits, and disclosures with reporting obligations

Operational disruption from malware, ransomware, phishing attacks and more

Complete alignment of Agency security policies to meet full compliance

External Pressures

Expanded and increased attack surfaces and home and remote work

Insurance as a high target results in elevated reputational and financial risk

Continuous shift of threat targets with increasing sophistication and frequency

Cyber Rules

Loud & Clear

Since 2012, SEC has produced hundreds of policies in dozen of documents (Risk Alerts, Observations, Cyber Exam, Guidance, etc.)

Independent Brokers & Agents

2021 SEC Exam Requirements at FCI Clients

“For Cybersecurity, your 1099 Advisors must be treated like Employees.”

BYOD

4/15/2014 SEC Audit Risk Alert IV.2

“You need to demonstrate controls over all endpoints accessing private data: Enforcing settings and cyber tools that users are prevented from altering.”

2020 SEC Exam Requirements at FCI Clients

"Provide a list of Endpoints that were decommissioned last year and the evidence there was no private data on them."

2020 Cybersecurity and Resiliency Observations

"Monitoring exfiltration and unauthorized distribution of sensitive information outside of the Firm (e.g., email, physical media, hard copy, or web-based file transfer) and evidencing this monitoring."

Testimonial

“We strongly recommend FCI to any firm with a desire to be cybersecure and compliant.”

Nash Subotic, Founder & CEO

Westpac Wealth Partners

WestPac is an Agency of The Guardian Life Insurance Company of America

Zero-Trust Managed Cybersecurity Services

Insurance Regulatory Compliance: Answering Specific Insurance Industry Requirements

MDL-668 & 23 NYCRR 500

Cyber Compliance

FCI ensures your firm meets NAIC, NYDFS and other cybersecurity regulation requirements related to Information Security Program and Safeguards

Customized Policy & Control Solutions

We work with large Carriers, Brokers, and Agencies to ensure cyber protection and consistency based on your security policies and goals.

Extended Cyber Team Support

Reduced Risk

Leverage a dedicated team with hundreds of thousands of incident, breach, and regulatory experiences – range matters.

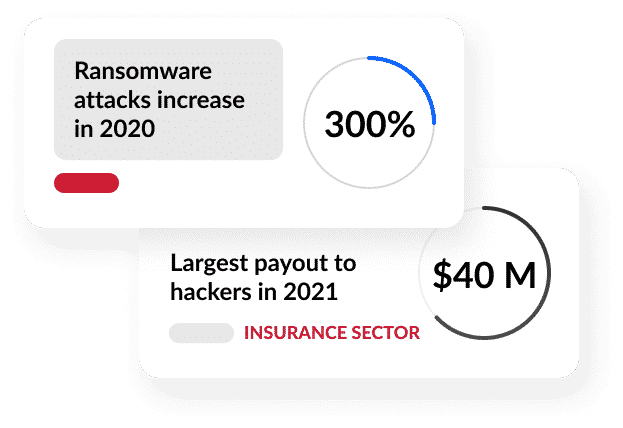

The Rise of Ransomware

Ransomware attacks are crippling many Insurance industry giants, resulting in massive operational disruption and costing millions in recovery efforts.

Additional risk factors that have contributed to the increasing ransomware attacks include human error and an evolving threat landscape.

A solution that augments and adapts to teams, skill sets and systems already in place

Co-Managed Cyber Services

How FCI partners with Enterprises, internal IT teams, and MSPs

Global Cyber

Executive Briefing

Insurance

Cyber attacks in the insurance sector are growing exponentially as insurance companies migrate toward digital channels in an effort to create tighter customer relationships, offer new products and expand their share of customers’ financial portfolios.

As insurers find new and innovative ways to analyze data, they must also find ways to secure the data from cyber attacks.

Are you prepared for a cyber audit?

At any time, regulators, authorities, and cyber insurers can knock at your door and ask for evidence of regulatory compliance. With a short complimentary call with FCI, we will let you know if you are ready for it.

Request a Cyber Audit Preparedness Call