COMMERCIAL

Cyber Insurance

To effectively leverage this growing line of business, Carriers and Brokers are adopting new models and ways of thinking to protect margins and improve loss ratios.

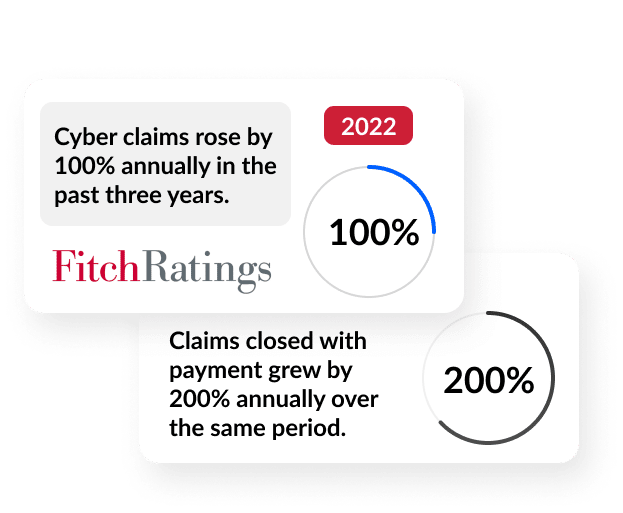

The Rise of Cyber Claims

Urgent Need for Change

The increasing sophistication of cyber threats, frequency of attacks and stringent regulatory requirements have created a shifting landscape for the Insurance Industry. The cost of claims and forensics post-breach are not sustainable as denials increase and premiums rise to compensate.

NYDFS Recommended Cyber Insurance Risk Framework

“Insurers must account for the systemic risk that occurs when a widespread cyber incident damages many insureds at the same time, potentially swamping insurers with massive losses.

Insurers that don’t effectively measure the risk of their insureds also risk insuring organizations that use cyber insurance as a substitute for improving cybersecurity, and pass the cost of cyber incidents on to the insurer“

Insurance Circular Letter No. 2, 2021

Provide Solutions & Education

Cyber Insurers have an important role to play in educating their insureds and offer more comprehensive information about the value of cybersecurity measures and facilitate their adoption.

Establish Compliance-Based Pricing

Insurers should also incentivize the adoption of better cybersecurity measures by pricing policies based on the effectiveness of each insured’s cybersecurity program.

Reduce Premiums

By identifying and pricing risk created by gaps in cybersecurity, cyber insurance can create a financial incentive to fill those gaps to reduce premiums.

Ensure Insureds' Clients Trust

By driving improved cybersecurity and cyber risk management, cyber insurance can also benefit consumers who entrust their sensitive data to these organizations.

Improve the Cyber Insurance Ecosystem

To reduce total claim payouts and improve loss ratios

For growth of a sustainable and sound cyber insurance market

New Key Roles

Commercial Insurance Brokers

Promote & Facilitate Pre-Application Cyber Protection & Compliance to Insureds

Cyber Insurers & Reinsurers

Tighten up Pre & Post-Breach Cyber Ecosystem Relationships & Processes

The Industry has always formulated the right model, cyber is no different

Leverage Proven Industry Models

If a car or house has a stronger security package, Insurance rates are often lower... Commercial Cyber Insurance is similar, if a firm has the right security in place and breaches don’t happen, rates could eventually go lower.

Pre & Post Breach Risk Management

Having better pre breach preparedness improves post breach ability to reduce claim scope, timing, and costs

Pre-Breach

Protection & compliance

- Security Risk Assessments

- Cyber Program Management

- Safeguards & Controls

- MFA, Logs, etc.

Synchronized Pre-to-Post Breach Model

Post-Breach

eDISCOVERY & forensics

- Leverage Pre-Breach Automation

- Review Logs & Evidence

- eDiscovery & Forensics

- Prepare Post-Mortem Report

BIGGEST RISK TO GLOBAL BUSINESS, 2022

Cyber Incidents

A New Model to Improve Loss Ratios

How to avoid premiums and renewal denials increase

Carriers & Brokers

Adopt Pre & Post Breach Risk Management Model

Brokers

Promote & Facilitate Pre-Application Cyber Protection & Compliance to Insureds

- Cyber Program Management

- Safeguards & Controls

- Security Risk Assessments

- Cyber Insurance Review

Insureds

Commit to Protection & Compliance

- Senior Management Involvement

- Cyber Program Management

- Vendor Risk Management

- Managed Security Service Provider Selection

Pre Breach Managed Security Service Providers (MSSPs)

Enforce & Evidence Insureds’ Protection & Compliance

- Cyber Insurance Application Review

- Understand Cyber Regulations

- Enforce Zero Trust Cybersecurity to Software, Endpoints, Users, and Networks

- Document & Retain Evidence of Compliance

- Work with Post Breach Firms to provide Logs and Evidence and for Remediation of Imminent Risks

Post Breach Firms

Perform eDiscovery & Forensics

- Leverage Pre Breach MSSPs for Evidence of Compliance & Remediation of Imminent Risks

- Perform eDiscovery & Forensics

- Prepare Post-Mortem Report

Carriers & Brokers

Experience Reduction in Claims which Improves Loss Ratios

Carriers, Brokers, Legal Firms, and Post Breach Firms

Contact us to discuss how we can help implementing new models to ensure viable cyber insurance business for all