SAFEGUARD SCANNING & EVIDENCING are critical

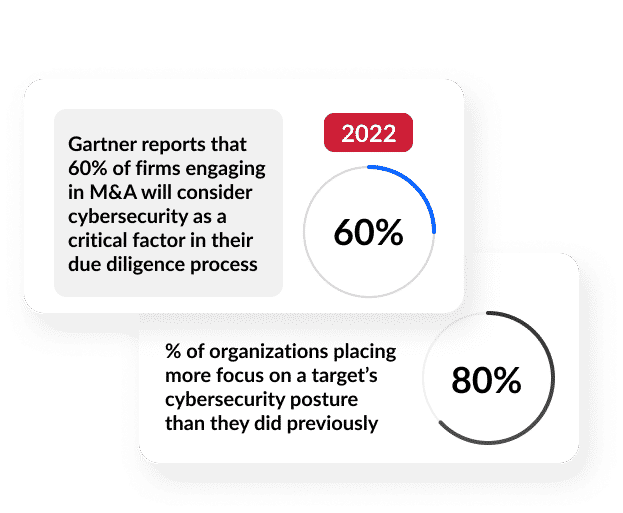

How cybersecurity impacts company valuation in M&A transactions

The most common deal-breakers in a sale or acquisition are lack of investment philosophy alignment and firm culture fit but it’s often undisclosed or breach information that can change deal valuations.

Request an estimate

For Buyers & Sellers

Cybersecurity can be overlooked in due diligence, but it’s a business risk and readily impacts the financial performance of a deal.

Are you buying firms?

reduce future liabilities

Examine and assess organizational exposure to cyber risk before the acquisition to ensure lower cybersecurity risk and liabilities

Are you selling your firm?

increase your valuation

Don't wait for security issues to be uncovered during due diligence - take a proactive approach with an assessment to cyber risk before selling

Testimonial

“FCI reduces our liability risk with a thorough Security Assessment of the Firms we acquire.”

Liz Tluchowski

Chief Information and Security Officer Principal

World Insurance Associates LLC

FCI expertise at its best

M&A Security Assessment

Often CISOs learn about or are asked to engage in acquisitions late in the deal lifecycle. This can expose organizations to significant risk. More than one in three executives surveyed said they have experienced data breaches that can be attributed to M&A activity during integration.

Scope & Deliverables

- Information Security Policies & Procedures Questionnaire

- Technical Controls Security Assessment

- Compliance Evidencing

- Remediation Plan & Actions

- Report & Recommendations

Ransomware Attackers Begin to Eye Midmarket Acquisition Targets

March 1, 2022

It just cost a Private Equity firm $1.2 million to have its systems released

HOW DO WE DIFFERENTIATE

Why chose FCI?

It is our job to go deeper. We ask for, validate, and document evidence of everything we audit. We also produce an initial report with recommendations, give you the opportunity to fix (remediate) what you can, and then re-assess what was changed. This process will give you an optimized final report!

FCI's Unique Way to Assess

- Trust but verify

- Ask and document evidence/proof

- Deliver first report with recommendations

- Allow for remediation

- Reassess and deliver final report

IBM’s Institute for Business Value

2019 Benchmark Study

Often CISOs learn about or are asked to engage in acquisitions late in the deal lifecycle. This can expose organizations to significant risk. More than one in three executives surveyed said they have experienced data breaches that can be attributed to M&A activity during integration.

industry trend

A Record Year for M&A Activity

2021 was another record in the number of deals and total client assets exchanged in the Registered Investment Advisor (RIA) industry which is likely to continue in 2022.

Echelon Partners’ RIA M&A Deal Report 2021 Annual Report and 2022 Outlook stated states that a total of $576 billion in client assets changed hands in 2021, an increase of almost 81% over 2020.

2021 M&A activity was hyperactive, with seller segments of all sizes surging. A seasoned and expanding

buyer pool was somewhat stretched to serve the 240+

sellers.

60% of the reported transactions occurred among firms with less than $50MM in AUM, which reflects the ongoing focus on partnering with larger, more mature firms to pursue continued growth and solve for succession

Safeguard Scanning & Evidencing

For Domains, CLOUDS, Networks & Endpoints

Technical Controls Security Assessment

- External & Internal Vulnerabilities

- Automated Vulnerability Scan

- Network Penetration Testing

- Dark Web Credential Scan

- Unrestricted Web Content

- Local Security Policy Consistency

- Identification of Unfollowed Technical Governance Procedures

Compliance Evidencing

- Screenshots & Pictures

- Summary & Detailed Reports

- Risk Score

Remediation Plan of Actions

- Remediation Recommendation

Pricing based on

- Number of domains, networks, servers, and endpoints

- Number of assessment teams for multiple domains or networks